Abstract

The rise of electric vehicles (EVs) has emerged as a transformative force in the global automotive industry, presenting unprecedented opportunities and challenges for economies worldwide. This research paper conducts a comprehensive comparative analysis of the economic impact of electric vehicles in two of the world’s largest automotive markets: China and the United States. By examining key economic indicators and policy initiatives, this study seeks to clarify the contrasting trajectories and implications of EV adoption in these countries.

The first section of the paper explores the growth and penetration of electric vehicles in China and the United States, shedding light on the disparities in market size, technological advancements, and consumer preferences. Furthermore, it delves into the respective national policies, incentives, and regulatory frameworks that have facilitated or hindered the widespread adoption of EVs in each country. By identifying the factors that have shaped the electric vehicle landscape, this study aims to provide insights into the divergent paths these two economic powerhouses have taken in embracing sustainable transportation.

The second section focuses on the economic consequences of electric vehicle integration. The analysis spans aspects such as job creation, investments, and supply chain dynamics in both China and the United States. Additionally, it examines the influence of EV adoption on traditional automotive industries, exploring how electric vehicles have disrupted conventional business models and affected revenue streams. By comparing the economic impacts of electric vehicles in these two economies, this research seeks to contribute to a nuanced understanding of the potential socio-economic benefits and challenges associated with the global transition to sustainable transportation.

Introduction:

Despite the creation of the first electric vehicle(EV) back in the 19th century, it took until the 2010s for people to begin adopting the electric vehicle. In a fusion of popular opinion, technological advancements, and government support, the EV skyrocketed with both investment and usage. As electric vehicles improve exponentially, the benefits of the electric vehicle are undeniable. While many studies have evaluated the societal and environmental impacts of EVs, this paper intends to focus on the economic impacts. The general worldwide trend of sustainable energy is what propels the drastic changes made in the car industry: the leading industry in generating greenhouse gasses by far. When taking steps to implement an alternative to gas powered vehicles, the economic measures must be taken into consideration to ensure the viability of the EV movement and establish it as more than a public trend that solely considers the environmental consequences.

Literature Review

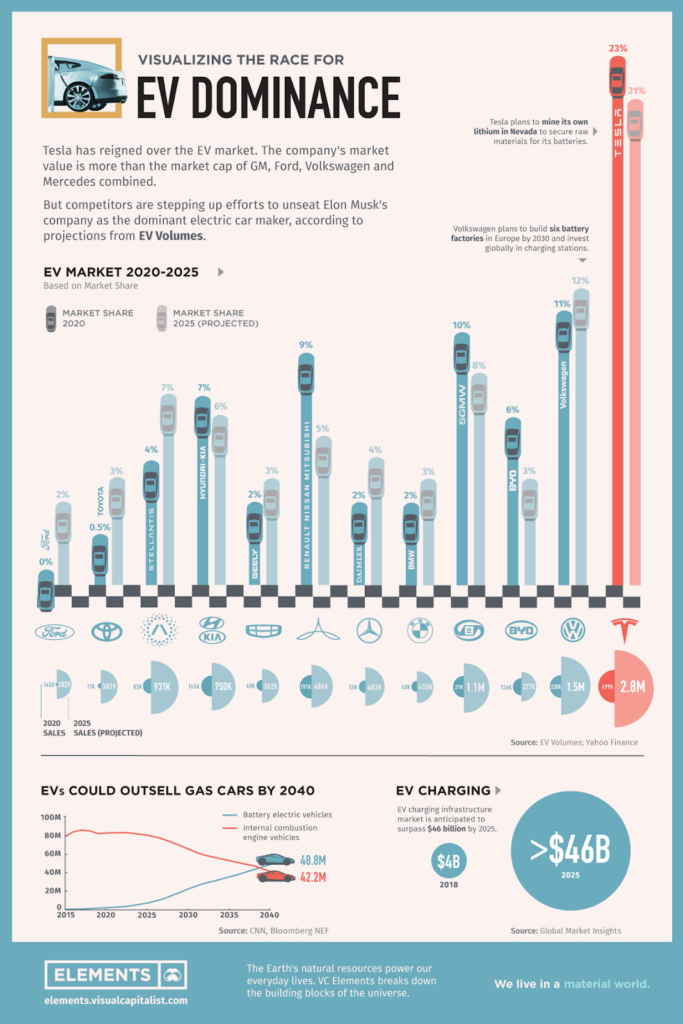

The EV market is one of the fastest growing industries, but the growth China saw in electric vehicle consumption is unparalleled. According to Zeyi Yang from MIT Technology Review: “In just the past two years, the number of EVs sold annually in the country grew from 1.3 million to a whopping 6.8 million, making 2022 the eighth consecutive year in which China was the world’s largest market for EVs.” The surge in demand for electric vehicles is accredited to many factors but the government played the most significant role in stimulating the supply and demand of EVs. Backtracking the success of EVs in China, the first hints of electric vehicle investment started back near the 2000s when China, at the time, was a powerhouse in manufacturing gas-powered vehicles but unable to compete with the foreign makers that dominated the market at the time. China faced a dilemma where they could continue manufacturing gas-powered vehicles or take a new route and explore the niche market of EVs during that time. Investing in something so new came with great risk, but if paid off, China could have a significant slice of the automobile market. The Chinese government plays a prominent role in guiding its economy and the government began funneling its resources to the rising market of EVs. With a series of subsidies that assisted suppliers and consumers, the reality of an alternative to gas-powered vehicles inched closer. More discrete incentives were also imposed such as the government making it much quicker and cheaper for an electric car owner to obtain a license plate in populous cities. Government subsidies are not restricted to solely domestic companies as Tesla thrives in China and both parties mutually benefit.

Impact on Chinese economy

China’s low labor cost allows it to produce goods at a significantly higher rate. This means that in the future China’s electric vehicle industry has the most potential to grow exponentially as resources for car batteries become easier to obtain. Major impacts on the economy include job creation, reduced dependence on foreign oil, and increased energy efficiency.

EV tax subsidies (statistic heavy)

Tax exemption in the US is much more complicated than it seems. The IRS offers a credit up to $7,500 for buying a new plug-in EV or FCV. The rules changed for vehicles purchased from 2023 to 2032. However, claiming the credit depends on your income tax and specific vehicle details, including its origin. The Federal tax credit for Electric Vehicles (EVs) remains at $7,500 and now extends from January 2023 to December 2032. Automakers like GM, Tesla, and Toyota regain eligibility for the tax credit as the cap on credits after selling 200,000 EVs is eliminated. The new bill suggests that the tax credit could be applied at the point of sale instead of waiting until the end of the fiscal year, but this might begin in 2024.

To qualify for the full tax credit, the EV must be assembled in North America. The credit consists of two binary pieces; the vehicle either qualifies for both pieces or none at all. One piece of $3,750 is based on the vehicle having at least 40% of its battery critical minerals sourced from the United States or countries with a free trade agreement with the US (listed in the agreement). The other $3,750 credit is contingent on at least 50% of the battery components coming from the United States or countries with a free trade agreement with the US. These percentage requirements are projected to increase by 10% each year until EVs with battery parts sourced from outside the US will no longer be eligible for tax credit.

End of subsidies in China (some incentives remain)

Originally set to end in 2020, China finally ended their subsidies for EVs in 2022. Many experts believe that the industry will continue to grow even without direct government subsidies. The Chinese government has found other ways to aid the EV industry such as devoting major resources to the research and development of EVs. According to Nitisha Aggarwal, the industry analyst at the Economist Intelligence Unit: “EVs are gradually transitioning from policy-driven to market-driven.” More discrete incentives remain such as the 10% tax exemption for current EV owners.

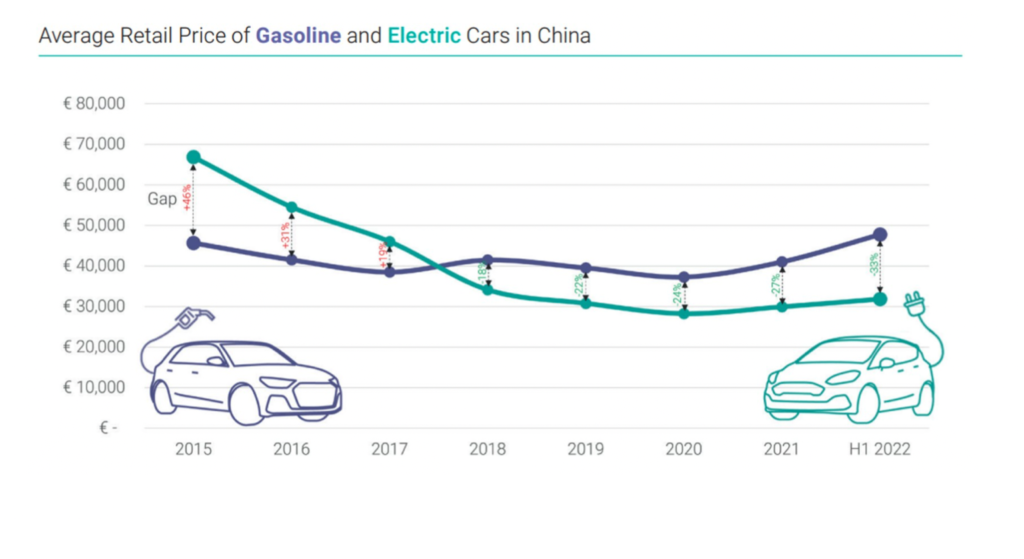

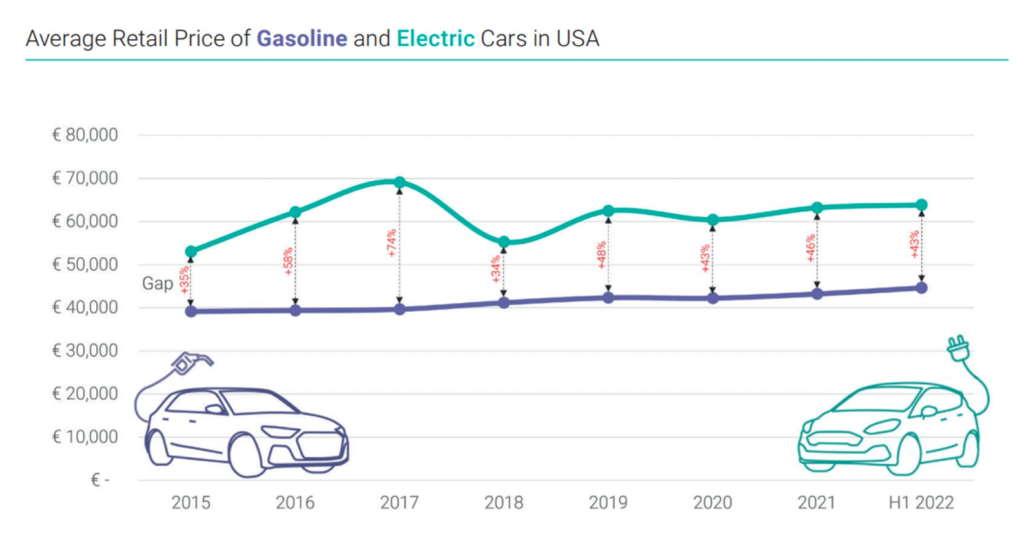

Costly EVs in the US

Despite the tax credit EV consumers get in the US, it does not compensate for the high prices. Car makers in the US tend to sell newer technology at a luxury price and gradually make it more affordable over time. At the current stage of development in the US, EVs remain accessible to mostly the rich which is why EV consumption in the US lags so far behind China. The average sticker price of an EV is $20,000 more than the typical gas-powered car. If the US cannot reduce the current price barrier, the goals Biden set to drastically cut emissions will not come to fruition as it would not be in the best interest of the majority of consumers to purchase an EV. The Inflation Reduction Act (IRA) gives $4000 of tax credit to those who buy used cars. Unfortunately, it only applies to cars sold under $25,000 and only 20% of electric cars are sold under that price.

Economic Setback (China)

The ambitious goal China has set for themselves has come to a halt due to the dramatic increase and volatility of metal prices(lithium, cobalt, nickel, manganese). Other studies have assumed that prices of car batteries will fall naturally as production increases, but the imbalance in supply and demand of raw materials may likely increase prices. Due to the uncertainty of the EV market and its future, many consumers are hesitant to purchase an EV despite the higher social value it has from government subsidies and would prefer the typical gas-powered car. The results from this article suggest that a potential cure to this problem is the improvement of recycling along with advancements in battery technology. The government plays a large role in supporting the research and development behind EV batteries specifically. More effort must be invested in order to discover alternative materials for EV batteries.

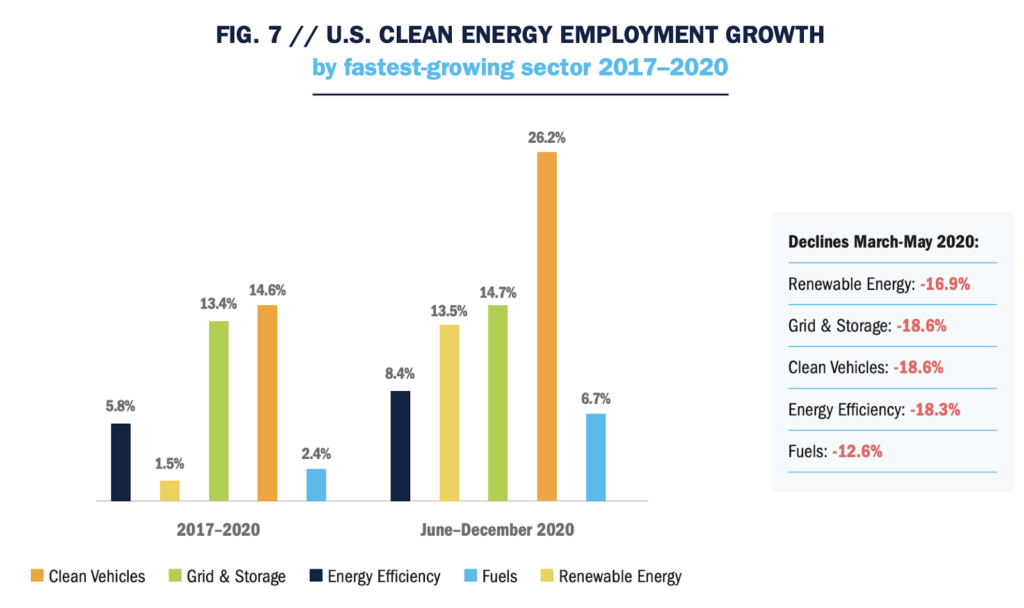

Job creation in the US

Auto manufacturing investment totals 88 billion across the US after the Infrastructure Law was passed. The Infrastructure Law allocated 7.5 billion for the 500,000 new EV chargers. “A new report from EDF and the consulting firm WSP found that more than half of the $120 billion in announced investments in EV-related factories over the last eight years and more than 94,000 new jobs announced have come since the passage of the Infrastructure Law in November 2021.”

Costs of China’s transition to EVs

As a result of the halt of government subsidies, China has mandated that a certain percentage of all vehicles sold by manufacturers each year must be battery powered. Experts believe that despite the severity of the mandate, it will decrease the cost of manufacturing EVs and batteries in the long run. A study done by MIT engineer William H. Green and graduate student Yun Lisa Hsieh in 2016 aimed to assess the total societal cost of the EV mandate by looking at: “battery prices, manufacturing costs, vehicle prices and sales, and the cost to the consumer of owning and operating a car.” The study concluded that battery prices will drop in the future due to the “learning effect,” the assumption that prices of goods will drop as efficiency increases. One caveat to the drop in battery prices is that as the price of a battery inches closer to the actual price of the sum of raw materials, prices will drop at a much slower rate because the price of raw materials remains rather stagnant. The study also showed how after the cut in subsidies, EVs are more expensive than their ICE and hybrid counterparts primarily due to the expensive battery. The total societal cost calculated of the transition to the target of 40% electric cars is approximately 0.1 percent of China GDP. It is apparent that the societal cost of EVs is significant as people will have less to spend on other goods.

Luxury Nature of EV and Effects on Gasoline Industry

The US currently faces the problem that the government continues to push for the transition to EVs but they remain unaffordable to the general public because EV manufacturers still see EVs as a luxury good and charge accordingly. The ambitious targets for the EV market are unrealistic as the US power grid cannot even support such a sudden transition to EVs. Upgrading the system will only add to the mountain of costs brought by the massive investment in public charging stations.

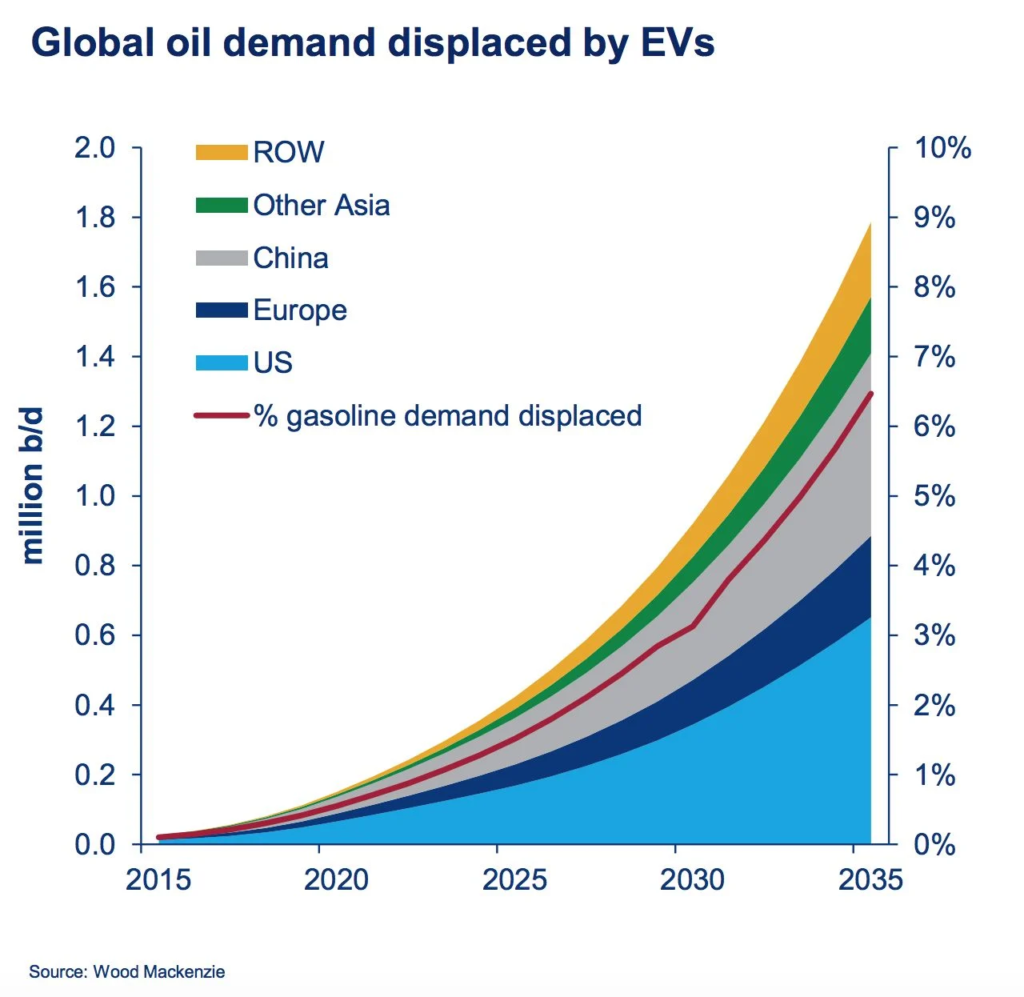

A major indirect consequence of EVs is that it completely shakes up the market for gasoline cars. Consumers are already spending a large amount more on energy and this shift to EVs will only increase oil prices as oil production drops. This leaves the remaining Americans that own gasoline cars in a lose-lose situation as they will either have to embrace the trend and purchase an EV for a much higher price or continue to pay much more for gasoline. This dilemma will cause a number of people to either work remote or in a place much closer to home which has the potential to reduce economic productivity as a whole.

Supply and Demand

Electric cars are only the first to come as buses and other means of public transportation go electric in the future. By 2022, China accounts for 60 percent of electric vehicles in the world with the US and Europe behind it.

“The encouraging trends are also having positive knock-on effects for battery production and supply chains. The new report highlights that announced battery manufacturing projects would be more than enough to meet demand for electric vehicles by 2030 in the IEA’s Net Zero Emissions by 2050 Scenario. However, manufacturing remains highly concentrated, with China dominating the battery and component trade – and increasing its share of global electric car exports to more than 35% last year.”

Total Factory Upgrade Required to Sustain Future EV Growth

The primary setback to the eruption of EVs in the past decade is the fact that batteries of electric vehicles are growing increasingly scarce as semiconductors and prices of rare earth materials such as lithium increased. The demand exceeds supply at this point because buyers recognize the social value of EVs but supply is struggling to keep up. Additionally, the charging stations required for the increase in EVs is lagging behind.

Ford and other carmakers have learned that shifting to electric vehicles necessitates a complete overhaul of their factories and supply networks. To facilitate this transition, they are supporting advanced battery manufacturers and directly collaborating with mining companies to secure essential raw materials. For instance, Ford is planning a $5.6 billion complex near Memphis dedicated to electric vehicle production. Global carmakers and suppliers plan to invest over $500 billion by 2026 to upgrade their manufacturing and supply chains, but it will take time for production capacity to match the demand. While electric vehicle sales are growing rapidly in the United States, Europe and China lead the way, with over 10 percent and 20 percent of new cars sold being battery-powered, respectively. Government policies, including quotas and subsidies, influence these numbers, as well as the availability of more affordable models. In the United States, government policies also play a significant role. California mandates manufacturers to sell a certain number of zero-emission vehicles, and the state’s residents own nearly 40 percent of all electric cars in the country. While the Biden administration’s efforts to promote electric vehicles nationwide through tax credits have faced strong opposition in Congress, California’s policies show the impact of such initiatives.

Analysis

After extensive research on a myriad of sources and viewpoints, certain competing views exist that should be addressed. While much of this paper dives into the subsidies behind the growth of EVs in both the US and China(the government’s way of using their “invisible hand”), a few articles argue that EVs should be taxed instead to discourage the general increase of vehicles on the road which leads to a higher social cost. By taxing EVs less than ICE vehicles, there will still be an incentive to purchase an EV.

The literature review highlights the remarkable growth of the electric vehicle (EV) industry, particularly in China, while also addressing the challenges and complexities facing both the Chinese and US markets. China’s aggressive push towards becoming a dominant player in the EV sector through government subsidies has undeniably propelled its success. The transition from policy-driven to market-driven growth signals a maturation of the Chinese EV market. However, the abrupt end of subsidies in China has led to concerns over raw material scarcity and battery prices. This shift from policy support to market competition may present risks, as the uncertain EV market could deter potential buyers despite lingering incentives like tax exemptions.

In contrast, the United States faces a different set of obstacles. Despite the extension of federal tax credits, the high initial costs of EVs deter widespread adoption, particularly among lower-income consumers. The luxury pricing strategy adopted by US carmakers inhibits affordability for the majority, and only further supports the perception of EVs as luxury goods. This pricing strategy not only obstructs President Biden’s emissions reduction targets but also exacerbates the existing income disparities in EV adoption. Lastly, the US power grid’s inability to support a rapid transition to EVs further complicates the issue, as a significant investment in infrastructure is required to facilitate widespread EV use. This is perhaps the largest concern for EV manufacturers as they will require far more advanced technology in the future to keep up with the demand while materials for current EV batteries become more and more scarce.

The literature review also underscores the importance of battery production and supply chains. China’s dominance in these areas indicates potential overreliance on a single market player, which could lead to supply chain vulnerabilities. Additionally, the raw material shortage’s potential to inflate battery prices and dampen EV adoption is a concern echoed by experts. While some advocate for enhanced recycling methods and technological advancements in battery technology to alleviate this issue, others maintain that the imbalance in supply and demand of raw materials requires comprehensive solutions. Meanwhile, the US’s emphasis on upgrading manufacturing and supply chains showcases a proactive approach, but the challenge of synchronizing production capacity with surging demand remains evident. The search for an alternative battery type continues because current batteries will not be sustainable in the near future. Unfortunately, batteries are the ceiling to the EV industry and without cheaper, more accessible types of batteries, the industry may not be able to reach its full potential.

Both China and the US have witnessed rapid developments in their respective EV markets, propelled by distinct factors. China’s transition to market-driven growth, despite its success, presents risks due to the sudden halt of government subsidies and potential raw material scarcity. In the US, affordability, infrastructure limitations, and luxury pricing strategies stand as significant barriers to equitable EV adoption. While both countries demonstrate strong government support and ambitious goals, the challenges faced by each underline the importance of balanced strategies that consider the economic, technological, and societal factors at play. Addressing these challenges necessitates a collaborative approach among governments, suppliers, and the consumers to achieve a sustainable and inclusive transition to electric transportation.

Conclusion

In essence, the rise of electric vehicles (EVs) is reshaping global transportation, carrying significant economic implications. This research examines EV impacts in China and the US, revealing shared trends and distinct challenges.

China’s ascent as a major EV market owes much to strategic policies and substantial subsidies. Yet, the shift from policy-driven to market-driven growth, marked by subsidy cuts, introduces challenges like material scarcity and higher battery costs, calling for balanced strategies.

Conversely, the US confronts unique obstacles. Luxury pricing by American carmakers impedes broader EV adoption due to steep upfront expenses. This pricing accentuates wealth gaps in EV ownership and threatens emission goals. Also, charging infrastructure inadequacy holds back widespread EV adoption.

Battery production and supply chain dynamics are focal points. China’s dominance brings supply chain concerns, while the US is proactive in upgrading manufacturing. Shared concerns about raw material scarcity fuel industry innovation and recycling.

EVs hold promise and complexity. China and the US showcase commitment via policies, tech, and infrastructure. Yet, their distinct issues call for holistic strategies, aligning economic, tech, and societal aspects. Success hinges on collaboration among governments, manufacturers, and stakeholders, propelling a greener future.

Ultimately, the EV surge reshapes the global economy. Lessons from China and the US guide policy and collaboration, steering the automotive sector towards sustainability and prosperity.

Recommendations

Battery research is arguably the most prominent area of future study. This research demonstrates how the EV industry is currently reaching its capacity as EV prices cannot go down unless cheaper alternatives to current battery materials are found. Research in specific battery materials along with their price range and functionalities is a great supplement to this paper. Building off the necessity to cut emissions, research in possibly making other means of public transportation could be done to better plan for a greener future. As of now, planes, buses, ships etc largely contribute to the release of carbon emissions. If the issue of a sustainable battery is resolved, it may open up possibilities to go electric in other types of transportation.

Government and business leaders play a large role in addressing the problems identified in the paper. Some short term recommendations are for:

- Governments to introduce stronger incentives to consume the more expensive EV

- Auto manufacturers to develop less expensive EVs

- Federal, state and local governments invest more resources in making charging far more accessible to consumers.

Small drawbacks such as these discourage buyers to take part in a cause for the environment.

In the long run, the government should focus on upgrading production lines to support the mass production of EVs. The current supply of EVs can hardly catch up with demand as it may take months to years for companies to deliver a singular EV. Lastly, countries around the world should collaborate to better the industry. Competition surely exists, but companies should keep an open mind to foreign advancements as it may be the first step of progress.

In essence, should the EV industry overcome its current constraints, it could have a major impact in reducing global warming.

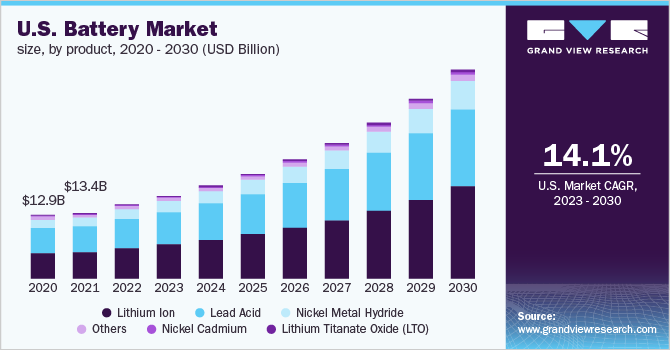

Exhibit 1

Exhibit 2

https://www.grandviewresearch.com/industry-analysis/battery-market

Bibliography

“Assessing the Impact of China’s Electric Car Industry on Its Economy.” Energy5. Accessed March 1, 2024. https://energy5.com/assessing-the-impact-of-chinas-electric-car-industry-on-its-economy#:~:text=It%20is%20 estimated%20that%20the,rates%20and%20boosting%20economic%20growth.

Doll, Scooter. “Here’s Every Electric Vehicle That Currently Qualifies for the US Federal Tax Credit in 2024.” Electrek, January 3, 2024. https://electrek.co/2024/01/03/which-electric-vehicles-qualify-us-federal-tax-credit-ev-2024/.

Ewing, Jack. “Electric Cars Too Costly for Many, Even with Aid in Climate Bill.” The New York Times, August 8, 2022. https://www.nytimes.com/2022/08/08/business/energy-environment/electric-vehicles-climate-bill.html. .

Ewing, Jack. “U.S. Electric Car Sales Climb Sharply despite Shortages.” The New York Times, July 14, 2022. https://www.nytimes.com/2022/07/14/business/electric-car-sales.html.

Galst, Liz. “New Climate Laws Drive Boom in Electric Vehicle Jobs.” Environmental Defense Fund – Building a vital Earth for everyone, March 15, 2023. https://www.edf.org/article/made-usa-bright-future-electric-vehicle-jobs.

Iea. “Demand for Electric Cars Is Booming, with Sales Expected to Leap 35% This Year after a Record-Breaking 2022 – News.” IEA, April 1, 2023. https://www.iea.org/news/demand-for-electric-cars-is-booming-with-sales-expected-to-leap-35-this-year-after-a-record-breaking-2022.

Li, Qiaoyi, and Liz Lee. “China Unveils $72 Billion Tax Break for Evs, Other Green Cars To …” Reuters. Accessed March 2, 2024. https://www.reuters.com/business/autos-transportation/china-announces-extension-purchase-tax-break-nevs-until-2027-2023-06-21/.

Mengnan, Jiang. “China Ends Electric Vehicle Subsidies.” China Dialogue, January 12, 2023. https://chinadialogue.net/en/digest/china-ends-electric-vehicle-subsidies/.

Stauffer, Nancy W. “China’s Transition to Electric Vehicles.” MIT News | Massachusetts Institute of Technology. Accessed March 1, 2024. https://news.mit.edu/2021/chinas-transition-electric-vehicles-0429.

Ritz, Ethan. “The Economic Consequences of Electric Vehicles.” The Economics Review at USC, November 15, 2022. https://usceconreview.com/2022/11/14/the-economic-consequences-of-electric-vehicles/.

Wang, Hetong, Kuishuang Feng, Peng Wang, Yuyao Yang, Laixiang Sun, Fan Yang, Wei-Qiang Chen, Yiyi Zhang, and Jiashuo Li. “China’s Electric Vehicle and Climate Ambitions Jeopardized by Surging Critical Material Prices.” Nature News, March 4, 2023. https://www.nature.com/articles/s41467-023-36957-4.

Yang, Zeyi. “How Did China Come to Dominate the World of Electric Cars?” MIT Technology Review, MIT Technology Review, 31 Aug. 2023, www.technologyreview.com/2023/02/21/1068880/how-did-china-dominate-electric-cars-policy/.