Introduction

According to the National Retail Federation, the retail industry grew by seven percent and to a combined value of 4.9 trillion dollars in 2021. With the growing industry of e-commerce, it is no surprise that the digital storefronts make up nearly 19% of retail sales. The online format allows for a more convenient shopping experience, thereby incentivizing consumers to purchase more items, as seen through the popularity of digital storefronts such as Amazon and Etsy. The rapidly increasing consumer base has led retailers to use psychological tactics to maximize profit, such as nudges, strategic product placement, and architecture. Physical and digital establishments, such supermarkets, malls and online stores, use behavioral economics and marketing principles to determine the best structures to incentivize consumers to spend more.

Grocery Stores

According to a survey conducted by the USDA Economic Research Service, nine out of ten consumers grocery shop for their household, online or in-person. Furthermore, Emily Rodgers, the Senior Marketing Manager of Drive Research, noted that in 2024, consumers make six grocery store trips every month. A majority of households shop at grocery stores frequently, viewing it as a weekly errand. However, oftentimes consumers walk out of shops spending more than intended, falling victim to the scheme at play. According to Knowledge at Wharton, the business journal from the University of Pennsylvania, 60-70% of items purchased at a grocery store are unplanned. Through the strategic product placement and reward incentives, grocery stores are a prime example of using behavioral economics to encourage higher sales.

Product Placement

Dairy Aisle

Product placement within grocery stores is a carefully crafted science, designed to delay the shopper and ensure that the consumer is spending large amounts of time within the store itself. The rationale is to activate the consumer’s decision fatigue, “‘the idea that after making many decisions, your ability to make more and more decisions over the course of a day becomes worse,’” thereby leading to irrational purchasing decisions that are based on the consumer’s wants not needs; recognizing this, stores make physical changes to increase the time consumers stay in the establishment. According to John Hitchcock, a MBA graduate, grocery stores are proven to elicit decision fatigue, and decision fatigue is the reasoning behind why consumers buy extra products at the checkout and.

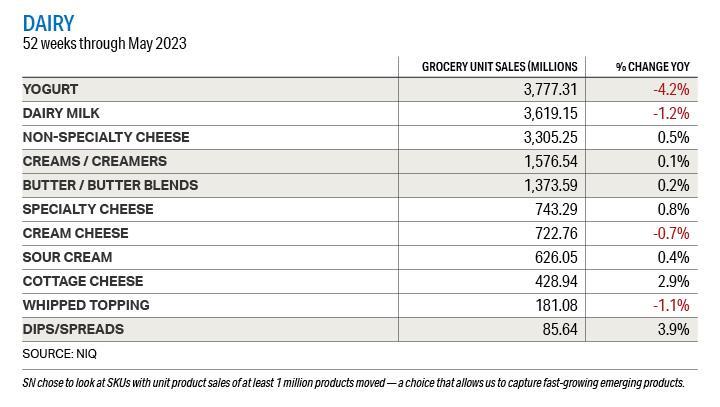

Dairy products are a common staple on every consumer’s grocery list. In fact, grocery stores make billions of dollars from the dairy aisle alone. (Table 1.01) According to a study reported by Emily Rodgers, dairy was “among the top grocery items people purchase,” clocking in at a percentage of 82%. Therefore, when designing stores, this section is often located at the very end of a supermarket, forcing consumers to wander the whole store to even reach the dairy aisle. This strategy is designed to expose consumers to as much product as possible and stray away from their original grocery list. According to a study conducted by Bangor University, at the 23 minute mark, our brain begins to utilize the emotional part to form decisions and at 40 minutes, the brain’s cognitive behavior is effectively shut down. The longer a consumer spends within the store, the more irrational their decisions become, and grocery stores use this to their advantage by strategically placing the dairy aisle at the back.

Shelving Products

When shelving products, grocery stores use a specific organizational method to maximize profit. Generally, [t]he name-brand expensive products are often placed at eye-level, while the cheaper alternatives are placed on the bottom shelf, hidden from view, encouraging consumers to purchase the more expensive product. As illustrated by Image 1.02, vertical shelves are divided into four separate sections: the stretch level, eye level, touch level, and stoop level. According to a study conducted by Gia Phua Lihua at Medium, products located on the stretch level and stoop level receive the least attention from shoppers. Therefore, the low-priced items are often placed here. However, the eye level, located at around four to five feet, is where products sell best for adults. These products receive 35% greater attention when compared to the items on the other shelves. On the other hand, the touch level “is where it sells best (for kids). Children [are] more likely to request parents to buy items placed at children’s eye level.” Therefore, candy and other appealing products to children are often located on this shelf.

Additionally, cheaper items, such as cakes, cookies, and other cheap sweets, are often positioned at the front of stores to entice consumers to purchase. According to a study by Christina Kan, a PhD in marketing, “‘[y]our attention is drawn not only to that one product that’s on sale, but it also spills over to the products that are located nearby.’” The study goes on to explain the cheap pricing strategy by stating “[t]his increases the likelihood of the shopper buying the promoted item, and it also heightens their awareness of surrounding products, which can lead to more purchases—both planned and unplanned.” Even if a consumer does not purchase the products at the front of the store, this tactic ensures that additional time is spent and small unconscious decisions are made, thereby activating decision fatigue.

Products located at the end of aisles, more formally known as “end caps,” generate more profit on average in comparison to products shelved on main aisles due to the larger consumer exposure. When consumers are searching for a specific aisle, they are more likely to identify products while passing through the store, instead of passing by items on main aisles. The extra presentation results in higher sales. According to a study conducted by the University of Southern California, the ends of the aisles are the most profitable sections to place products. In fact, manufacturers will often pay extra money in order to place their products at the end of aisles. Although companies spend millions of dollars to secure end cap placement, in the long term, this business move is worth it. According to the National Retail Hardware Association, products at the end of the aisle have been proven to sell eight times as fast as products located within the aisle. End caps seem to be prime-real estate for both the grocery store and the companies placed there.

Incentivize Returning Through Reward Programs

Many supermarkets offer special deals to members of their reward program, including Safeway, Target, and Walmart to name a few. In fact, in 2021, Target celebrated their Circle rewards program hitting 100 million members. Enrolling in a rewards account is typically free, which might initially give the impression that the grocery store is incurring losses through this initiative. However, these reward accounts are in place to motivate consumers to return, often sending out emails on the latest deals. According to a survey conducted by Queue-It, loyalty programs generate 12-18% more revenue growth per year. Additionally, 83% of purchasing decisions are influenced by loyalty programs, and 75% of consumers in loyalty programs will buy more products. Reward programs are a powerful initiative, leading to an increase of returning consumers, brand loyalty, and money spent.

Mall Store Placement

Similar to grocery stores, malls try to make their environments as pleasant as possible, incentivizing consumers to spend large amounts of time inside the building. Through location and architecture, malls use store placement and ambience to ensure the enjoyment of each consumer and encourage return. As reported by an article from The Real Deal, a real estate magazine centerned in Los Angeles, New York and South Florida, there is a correlation between the size of a mall and the amount of money spent, as the average revenue for a mall in the U.S. is around $600 per square foot. Additionally, malls are unique in their method to draw in consumers, creating an affable environment that consumers will naturally be drawn towards. Malls are not exclusively seen as a location to spend money, rather a place to socialize and spend time with loved ones. This unique strategy to pull consumers is proven to work as the average mall made 7.5 billion dollars of revenue in 2022, according to CNN.

Location & Architecture

When constructing a mall, the architects focus on creating a luxury environment to motivate consumers to spend multiple hours within the building. According to a study conducted by Fereshteh Bijandi and Tooraj Sadeghi from Islamic Azad University, “[r]esults show that the atmosphere or environment of the shopping mall may be a useful mean for making approach behavior. In addition…[t]he results of the research show that buyers react positively despite their different cognitions and values in respect to environmental effects.” In fact, malls will often include facilities such as escalators, air conditioning and washrooms, which has been proven to “affect consumer evaluation while they make decision in choosing a shopping mall.” The nicer the mall’s architecture, the more time spent by consumers, which in turn results in more money spent. Decision fatigue is also applicable to malls, as the more time individuals spend inside a mall, the more susceptible they are to making irrational decisions and making unnecessary purchasing decisions.

Store Selection

Unlike grocery stores, consumers go to malls for an enjoyable time, not necessarily with the intention of running an errand. Oftentimes, individuals will use malls as an outlet to spend time with their friends and family, partly due to the strategic architecture in place. Consumers display emotions of “thrill seeking, socializing and desire to stay in the shopping mall,” and visit malls as an opportunity “to communicate with other people apart from those in own house,” concluding that “an important aspect in visiting a shopping mall…includes the opportunity to interact with friends, family, or even strangers while at the mall.” According to a study located in the 62nd volume of the Journal of Retailing and Consumer Services written by economics graduates Xi Li , Wirawan Dony Dahana , Qiongwei Ye , Luluo Peng , and Jiaying Zhou , “[t]he results for the shopping duration model reveal that promotional activities lead customers to stay longer at a mall, as the parameter estimate of the promotion variable is significantly positive (δ1=0.02,SD=0.00).” Therefore, malls will often include arcades and other interactive activities to encourage consumers to spend even more time within the building. Additionally, many consumers will arrive at the mall to specifically participate in these activities, and may explore the vicinity after, leading to a higher exposure of the other stores.

Digital Stores

Unlike traditional brick and mortar storefronts, online retailers use different behavioral economic strategies to incentivize consumers to spend money. With the constant rise of online retailers, these tactics have become more prevalent. In 2023 alone, 81% of the total population in the United States shops online. The online shopping experience provides comfort and a larger base of accessibility, leading to an increase of online shoppers. With use of nudges, such as seasonal discounting, free shipping, and decision paralysis, online retailers have mastered the use of behavioral economics to maximize profit.

Nudges

Seasonal Discounting and Free Shipping

The first tactic used is seasonal discounting. Customers are more likely to purchase items on sale, rather than on full price. This is often why websites will include the “original” price when displaying sales. It points to the concept of loss aversion: as humans we hate the feeling of loss, and discounting allows us to feel like we are gaining utility. Furthermore, this tactic also uses a concept known as anchoring. According to Essentia Analytics, “‘[a]nchoring’ is our tendency to rely on the first piece of information we come across when making a decision. The retailer presents us with, for example, a $200 juicer reduced down to $140. That original $200 price tag ‘anchors’ as a reference point in our minds. As a result, the discounted price now seems much more reasonable than if we’d seen the juicer being sold at $140 with no reduction.”[1] When reading the crossed out original price, customers set their reference point at that specific price, and the discounted price seems like less of a loss. Additionally, seasonal discounts come with a time restraint, creating a sense of urgency which helps justify the purchase. These promotional “[e]vents like Black Friday and Cyber Monday are the Superbowl of behavioral manipulation for holiday shoppers. Amazon’s own event – Prime Day – grossed an estimated $4.2 billion in 2018.”[2]

Displaying sales are just one example of nudges used by grocery stores. Often, retailers will provide free shipping once an order surpasses a certain threshold. Customers would rather spend their money on more product than a shipping cost, incentivizing them to add items to their cart that are not necessarily needed. In fact, online retailers take advantage of this “set[ting] their free shipping thresholds above their average online order value, to increase sales.” Once customers receive the items, very few actually return it. The psychology behind this stems from post-purchase rationalization, “a cognitive bias whereby someone who has bought an expensive item overlooks any faults or defects in order to justify its purchase.” Since the product is viewed as expensive from the reference point, customers are less likely to return it even when it is not providing its maximum utility due to the price tag associated with the product.

Decision Paralysis

Online stores, such as Amazon, are known for their wide range of products, and this is done on purpose. According to the International Institute for Management Development, “[e]-retailers have an advantage over brick and mortar supermarkets: instead of reducing the number of products they offer, they can help the shopper overcome decision paralysis by making the search for the right product as easy as possible.” Using the search bar, consumers can narrow down the products, a capability not offered by in-person shopping. However, the large number of products “means purchase decisions are more difficult and some customers will not buy at all. For e-commerce, this can mean increased shopping cart abandonment.” In fact, 69% of online shoppers abandon their carts. In order to combat this problem, online retailers will send out emails and notifications reminding consumers that there are products selected in their cart. Some of these notifications introduce a sense of urgency, naming the limited number available. By introducing this nudge, these emails remind shoppers to complete their purchase with a “scarily high success rate.”

Conclusion

The art of shopping is not purely transactional– rather, it is a carefully constructed science filled with behavioral economics principles and psychological tactics. By recognizing the structural changes stores make to incentivize increased spending, consumers can prevent excess spending and make more rational decisions when it comes to purchases. The initial step is awareness and by dissecting the nudges and tactics used by retailers, we empower ourselves to navigate the consumer landscape with clarity.

Bibliography

Barkho, Gabriela. “Target’s Circle Rewards program hits 100 million members.” Modern Retail. Last modified August 20, 2021. Accessed April 27, 2024. https://www.modernretail.co/retailers/targets-circle-rewards-program-hits-100-million-members/.

Berg, Sara. “What doctors wish patients knew about decision fatigue.” American Medical Association. Last modified November 19, 2021. Accessed April 27, 2024. https://www.ama-assn.org/delivering-care/public-health/what-doctors-wish-patients-knew-about-decision-fatigue.

Hill, Katy Marquardt. “Store display psychology: Why you end up buying things near sale items.” CU Boulder Today. Last modified June 27, 2023. Accessed April 27, 2024. https://www.colorado.edu/today/2023/06/27/store-display-psychology-why-you-end-buying-things-near-sale-items.

Hitchcock, Joe. “Decision Fatigue – Everything You Need to Know.” InsideBE. Accessed May 12, 2024. https://insidebe.com/articles/decision-fatigue/.

“Inspire Higher Sales with Smart End Caps.” National Retail Hardware Association. Accessed April 27, 2024. https://pwfourstar.com/proven-profits-2014-04-endcaps.

“LA malls exceed national average with $800 psf in annual sales.” The Real Deal. Last modified September 18, 2023. Accessed May 5, 2024. https://therealdeal.com/la/2023/09/18/la-malls-exceed-national-average-with-800-psf-in-sales/.

Li, Xi, Wirawan Dony Dahana, Qiongwei Ye, Luluo Peng, and Jiaying Zhou. “How Does Shopping Duration Evolve and Influence Buying Behavior? The Role of Marketing and Shopping Environment.” Journal of Retailing and Consumer Services 62 (September 2021): 102607. Accessed May 5, 2024. https://doi.org/10.1016/j.jretconser.2021.102607.

Lihua, Gia Phua. “Eye level is buy level — The Principles of Visual Merchandising (and Shelf Placement).” Medium. Last modified April 3, 2016. Accessed April 27, 2024. https://medium.com/@giaphualihua/eye-level-is-buy-level-the-principles-of-visual-merchandising-and-shelf-placement-5f2fd8f7f298.

“Not on the List? The Truth about Impulse Purchases.” Knowledge at Wharton. Accessed April 27, 2024. https://knowledge.wharton.upenn.edu/article/not-on-the-list-the-truth-about-impulse-purchases/#:~:text=In%20his%201999%20book%20Why,industry%20studies%20have%20shown%20us.%E2%80%9D.

“Psychology of the Grocery Store.” USC Dornsife. Last modified November 17, 2023. Accessed April 27, 2024. https://appliedpsychologydegree.usc.edu/blog/psychology-of-the-grocery-store.

Pynegar, Edwin. “MRI to understand how we shop.” Seren. Last modified December 11, 2013. https://www.seren.bangor.ac.uk/discovery/science/2013/12/11/mri-to-understand-how-we-shop/.

Rajagopal, Alarice. “Cheese and milk continue to dominate.” Supermarket News. Last modified August 25, 2023. Accessed April 27, 2024. https://www.supermarketnews.com/dairy/cheese-and-milk-continue-dominate.

Restrepo, Brandon J., and Eliana Zeballos. “New Survey Data Show Online Grocery Shopping Prevalence and Frequency in the United States.” USDA Economic Research Service. Last modified February 8, 2024. Accessed April 27, 2024. https://www.ers.usda.gov/amber-waves/2024/february/new-survey-data-show-online-grocery-shopping-prevalence-and-frequency-in-the-united-states/#:~:text=The%20survey%20data%20revealed%20that,in%20the%20last%2030%20days.

Rodgers, Emily. “Grocery Store Statistics: Where, When, & How Much People Grocery Shop.” Drive Research. Last modified April 25, 2024. Accessed April 27, 2024. https://www.driveresearch.com/market-research-company-blog/grocery-store-statistics-where-when-how-much-people-grocery-shop/.

Rothenberg, Eva. “The US Mall Is Not Dying.” CNN. Last modified August 21, 2023. Accessed May 5, 2024. https://www.cnn.com/2023/08/20/business/shopping-mall-retail-growth/index.html#:~:text=Between%202020%20and%202022%2C%20these,growth%20rate%20of%20nearly%209%25.

Sadeghi, Tooraj, and Fereshteh Bijan. “The Effect of Shopping Mall Environment on Shopping Behavior under a Model.” Middle-East Journal of Scientific Research. Last modified 2011. Accessed May 5, 2024. https://www.idosi.org/mejsr/mejsr8(3)11/4.pdf.

“79 staggering statistics that show the power of loyalty programs in 2024.” Queue-It. Last modified December 21, 2023. Accessed April 27, 2024. https://queue-it.com/blog/loyalty-program-statistics/#:~:text=11.,the%20companies%20they%20partner%20with.

“State of Retail.” National Retail Federation. Accessed May 12, 2024. https://nrf.com/research-insights/state-retail#:~:text=NRF%20forecasts%20that%20retail%20sales,retail%20sales%20growth%20of%203.6%25.

“Top 10 Online Shopping Nudges.” Essentia Analytics. Accessed May 12, 2024. https://www.essentia-analytics.com/behavioral-nudges-for-online-shoppers/.

Walsh, John W., and Valerie Keller-Brirrer. “Behavioral Economics in the Digital World.” International Institute for Management Development. Last modified May 2019. Accessed May 12, 2024. https://www.imd.org/research-knowledge/marketing/articles/behavior-economics-in-the-digital-world/.

Ward, Brad. “What Is Choice Paralysis – and is it a Problem for Online Retailers?” SaleCycle. Last modified August 11, 2022. Accessed May 12, 2024. https://www.salecycle.com/blog/strategies/is-choice-paralysis-a-problem-for-online-retailers/.